Double declining method calculator

Divide the basic annual write-off by the assets cost. The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an asset has lost since.

Depreciation Calculator

It takes the straight line declining balance or sum of the year digits method.

. Multiply the result by. Determine the initial cost of the asset at the time of purchase. Sum of the Years Digits Depreciation Method Quite close to the declining balance depreciation method this method also results in accelerated depreciation during the useful early life of an.

A decrease in the asset values is called as depreciation. The following calculator is for depreciation calculation in accounting. For other factors besides double use the Declining Balance Method.

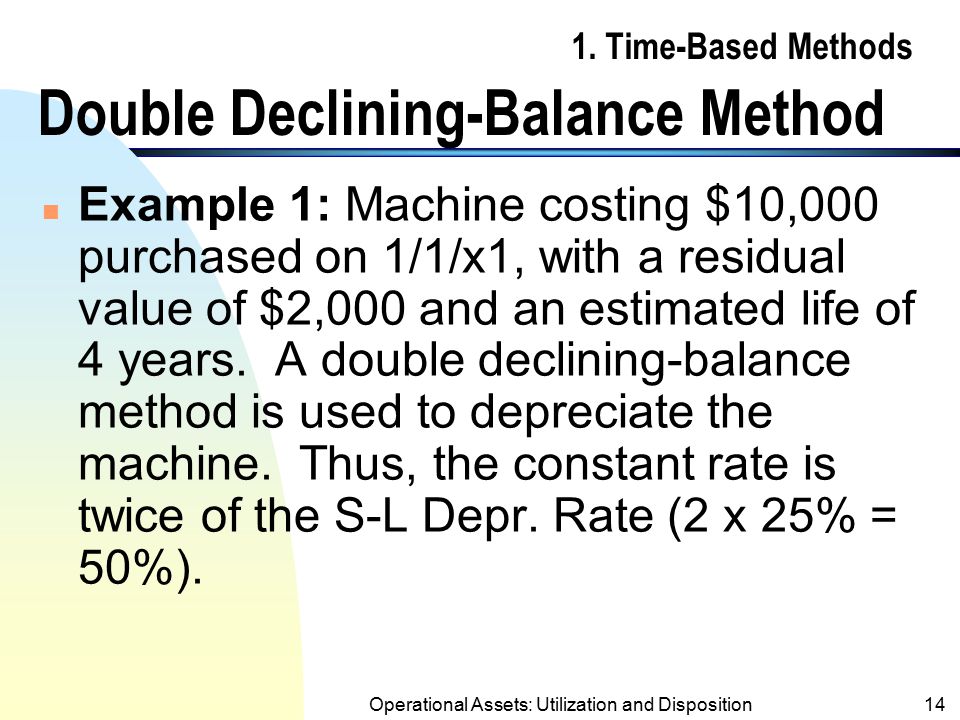

Assuming an asset has a life of five years and the declining balance rate is 150 percent the accelerated depreciation rate is 30 percent which is 100 percent divided by 5 multiplied by 15. Calculate the yearly depreciation expense. Returns a value specifying the depreciation of an asset for a specific time period using the double-declining balance method or some other method you specify.

Use this calculator to calculate the accelerated depreciation by Double Declining Balance Method or 200 depreciation. Description of DDB function. If you are using the double declining.

A method of allowing higher deductions depreciation in starting or earlier years is called as the. There are several steps to calculating a double-declining balance using the following process. The following methods are used.

The double declining balance depreciation method shifts a companys tax liability to later years when the bulk of the depreciation has been written off. If we want to calculate the basic depreciation rate we can apply two formats. MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

The company will have. Each year multiply the assets book value at the beginning of the year by the depreciation rate to determine the depreciation.

Declining Balance Method Definition India Dictionary

Double Declining Balance Depreciation Guru

What Is The Double Declining Balance Depreciation Method Quora

Double Declining Depreciation Calculator Efinancemanagement

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Double Declining Balance Depreciation Daily Business

Fixed Assets

Double Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Finance In Excel 6 Calculate Double Declining Balance Method Of Depreciation In Excel Youtube

Double Declining Balance Depreciation Method Youtube

How To Use The Excel Db Function Exceljet

How To Use The Excel Ddb Function Exceljet

Double Declining Depreciation Efinancemanagement

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template